Dyness Knowledge | Dynamic electricity pricing and energy storage opportunities for European C&I sectors

-

Technical Blog

-

2026-01-08

-

Dyness

Against the backdrop of accelerated energy transition in Europe, the industrial and commercial electricity market is exhibiting a significant trend of increased price volatility and widening peak-to-off-peak price differences. This creates considerable economic opportunities for energy storage systems. This change is primarily driven by multiple factors, including the surge in renewable energy installations, fluctuations in traditional energy prices, and the evolution of electricity market mechanisms.

Arbitrage opportunities under dynamic electricity pricing mechanisms:

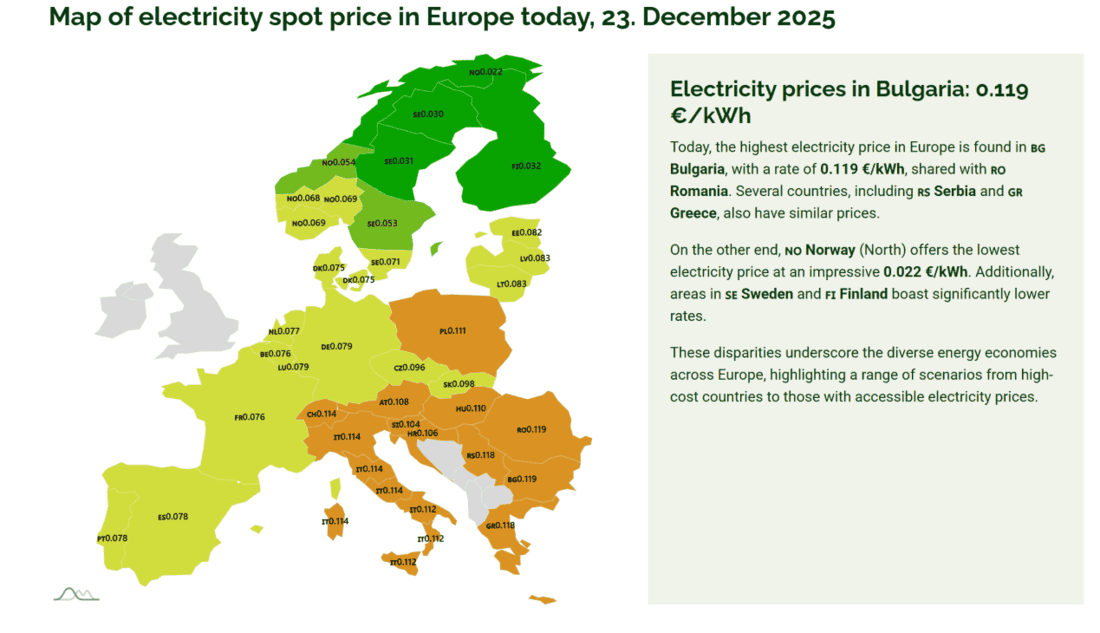

Currently, price volatility in the European spot electricity market has increased significantly. On the one hand, the high penetration of renewable energy generation, particularly solar power, has directly led to the frequent occurrence of "negative electricity prices." Statistics show that in the first half of 2025, several countries, including Sweden, Spain, the Netherlands, and Germany, experienced negative electricity prices for over 300 hours. Data from the International Energy Agency (IEA) shows that in 2024, the duration of negative electricity prices in Finland reached 8% (approximately 700 hours), while in Germany, Sweden, and the Netherlands, the proportion also increased to 5%-7%. These periods of negative prices mostly occur in the afternoon when wind and solar power generation is high. On the other hand, when renewable energy generation decreases (such as at night or during periods of low wind), electricity demand still needs to be met by traditional fossil fuels, causing electricity prices to surge. For example, in February 2025, due to rising natural gas costs and decreased wind power output, electricity prices in core markets such as Germany and France reached their highest levels since March 2023. This dramatic price fluctuation has widened the peak-to-trough price difference in the spot market. According to industry analysis, the average peak-to-trough price difference in many regions of Europe exceeded 85 euros/MWh in 2025.

This dynamic electricity pricing environment provides a clear arbitrage model for commercial and industrial energy storage: charging when electricity prices are low (or even negative) and discharging when prices are high for self-consumption or sale to the grid. Market analysis indicates that under this mechanism, the internal rate of return (IRR) of typical commercial and industrial energy storage projects in Germany can be increased to approximately 16.88%, and the payback period can be shortened by more than 30%. Overall, the return on investment for energy storage projects in most European countries has generally reached 10%-15%.

The core factors driving the development of energy storage are:

The increased profitability of energy storage is the result of the combined effects of market forces, costs, and policies.

1. Market Structural Demand: The European power system has an urgent need for flexible resources. Frequent negative electricity prices expose the system's difficulty in balancing intermittent renewable energy generation due to a lack of sufficient energy storage and demand-side response. Energy storage is a key technology to address this bottleneck.

2. Continuous Improvement in Economics: The cost of energy storage systems continues to decline, enhancing project economics. For example, the unit price of prismatic lithium iron phosphate batteries has fallen significantly from its peak in 2022. At the same time, the profit margin from electricity price fluctuations is expanding, making energy storage investments significantly more attractive.

3. Supportive Policy Framework: The EU and national governments are actively building a favorable market and regulatory environment. The Affordable Energy Action Plan released by the EU in early 2025 aims to lower electricity prices through improved market design and accelerated renewable energy deployment. More importantly, following events such as the large-scale power outage in Spain in 2025, countries are paying more attention to grid stability and have introduced more supportive policies regarding energy storage grid connection approval and capacity market mechanisms, directly incentivizing energy storage investment.

Market Prospects and Challenges

Driven by the factors mentioned above, the European commercial and industrial energy storage market is entering a period of rapid growth. Industry forecasts predict that the European commercial and industrial energy storage market will maintain a compound annual growth rate of over 55%, with installed capacity expected to increase more than fivefold between 2024 and 2029. In the long term, it is estimated that by 2030, the new installed capacity demand in the European energy storage market will reach 165 GWh, corresponding to a market size of approximately 170 billion RMB. Despite the promising outlook, the large-scale development of energy storage still faces challenges, including insufficient grid infrastructure and cross-border interconnection capacity, as well as the need for more comprehensive market rules and electricity pricing structures to fully unlock the potential of flexible resources.

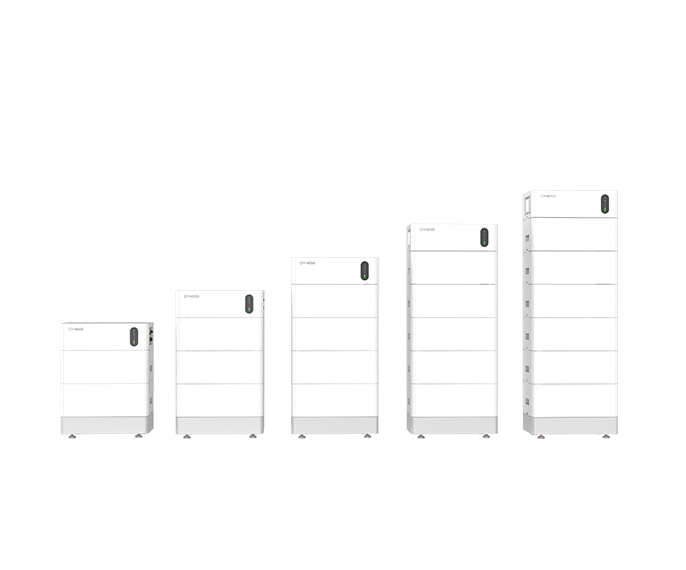

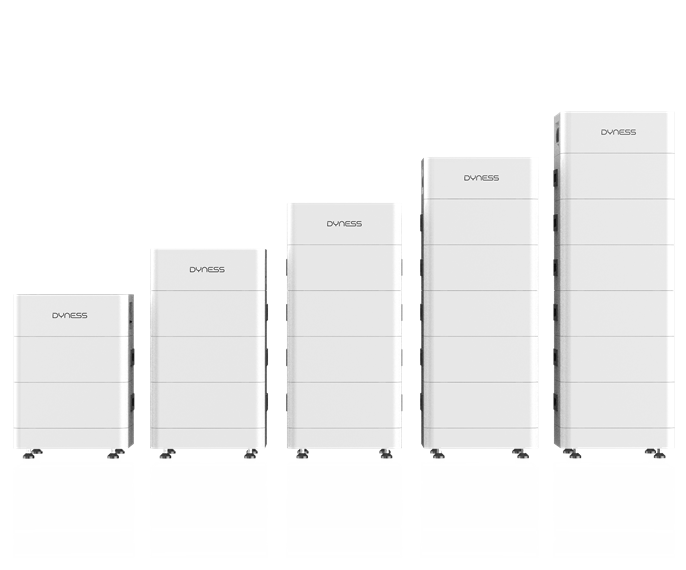

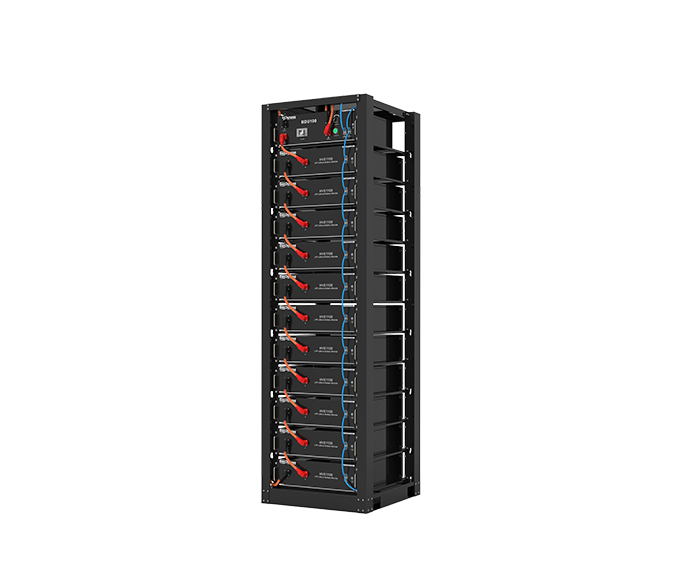

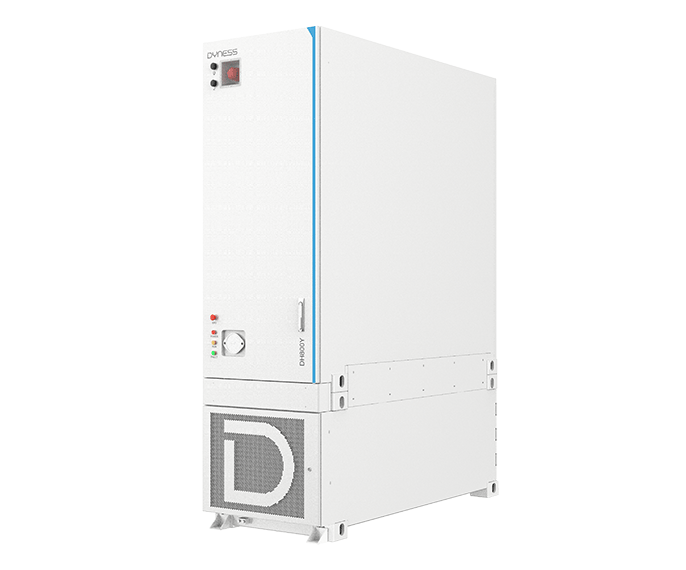

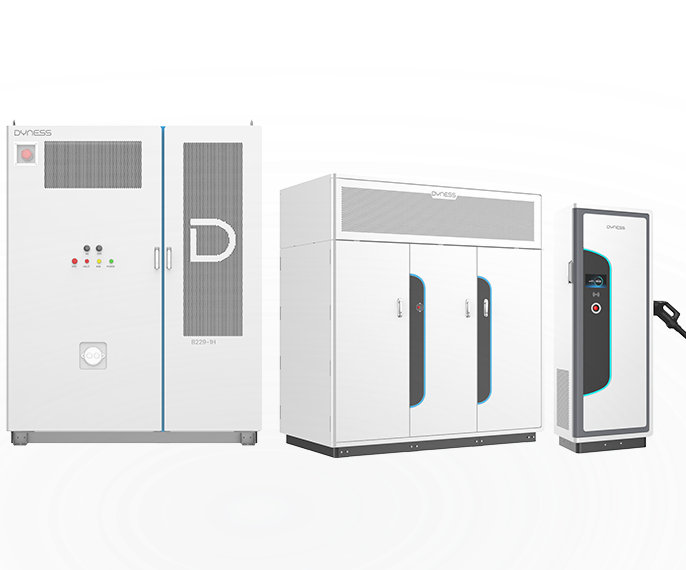

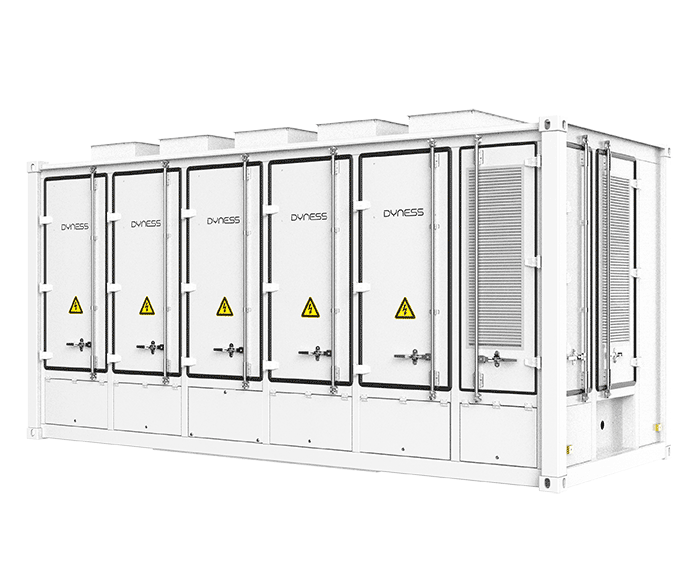

The compatibility of Dyness commercial and industrial energy storage products.

Dyness's commercial and industrial energy storage products cover all application scenarios, including the relatively new dynamic pricing scenarios in Europe. For this scenario, due to the frequent charging and discharging operations, liquid-cooled integrated systems are more suitable. Liquid cooling provides higher precision temperature control, keeping the temperature difference between battery packs within 2-3°C, thus mitigating the risk of thermal runaway. At the same time, system energy consumption is significantly reduced, and system efficiency is improved. Most importantly, liquid-cooled systems have stronger environmental adaptability, guaranteeing profitability. Dyness currently offers two liquid-cooled integrated systems: DH200Y and DH800Y. The DH200Y is suitable for low-voltage user-side scenarios, while the DH800Y is suitable for medium-voltage grid-side scenarios. They can effectively cover all dynamic pricing scenarios in Europe, and when combined with an intelligent energy management system (EMS), they can obtain real-time information on the latest day-ahead electricity prices to adjust charging and discharging strategies.

In summary, the increasing volatility of electricity prices in Europe is not a short-term fluctuation, but a natural consequence of its energy structure transitioning towards a high proportion of renewable energy. This opens a sustainable profit window for commercial and industrial energy storage, centered on market arbitrage and also offering value in improving energy self-sufficiency and grid stability. As technology costs decrease and policy mechanisms mature, energy storage is shifting from being policy-driven to being driven by stable economic viability, becoming a key pillar in building Europe's new power system. Dyness will recommend the most suitable commercial and industrial energy storage products to help customers maximize their profits in the dynamic electricity pricing environment of Europe!